LA REUNION SECRETA DONDE SURGIO LA RESERVA FEDERAL Federal Reserve

Página 1 de 1.

LA REUNION SECRETA DONDE SURGIO LA RESERVA FEDERAL Federal Reserve

LA REUNION SECRETA DONDE SURGIO LA RESERVA FEDERAL Federal Reserve

The Secret Meeting That Launched the Federal Reserve

Posted on February 20, 2012 | Leave a comment

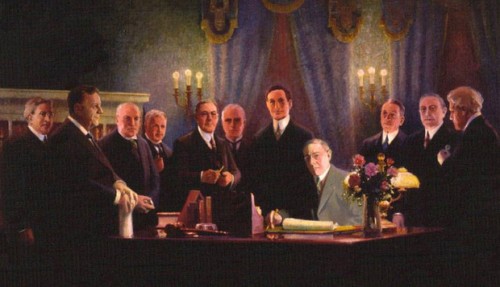

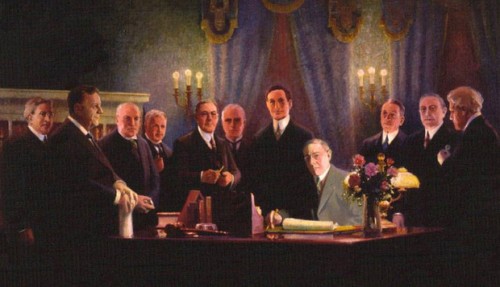

President Woodrow Wilson signing the Federal Reserve Act in 1913. Source: Woodrow Wilson Birthplace Foundation, painting by Wilbur G. Kurtz Sr.

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world — no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men.”

- President Woodrow Wilson reflecting in 1916 on his approval of the Federal Reserve Act in 1913. Quoted in “National Economy and the Banking System,” Senate Documents Co. 3, No. 23, Seventy-sixth Congress, First session, 1939

“Since I entered politics, I have chiefly had men’s views confided to me privately. Some of the biggest men in the United States, in the Field of commerce and manufacture, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they better not speak above their breath when they speak in condemnation of it.”

- President Woodrow Wilson, The New Freedom, 1913

bloomberg.com | Feb 15, 2012

By Gregory DL Morris

Although it may seem shocking to watch the 112th Congress, there was a time when national leaders were swift and decisive in getting things done. In November 1910, in the space of less than two weeks, a group of government and business leaders fashioned a powerful new financial system that has survived a century, two world wars, a Great Depression and many recessions.

Of course, the Jekyll Island conference, which met that month, was dodgy even by the standards of the Gilded Age: a self-selected handful of plutocrats secretly meeting at a private resort island to draw up a new framework for the nation’s banking system. Add in the gnarly live oaks and dripping Spanish moss of coastal Georgia, and the baronial becomes baroque.

The group’s original plan wasn’t ratified by Congress, but one very much like it was adopted and became the basis of the Federal Reserve system that remains in place today.

At the time, the Panic of 1907 was still fresh in everyone’s mind. J.P. Morgan had resolved that panic by locking the heads of major banks in his library overnight, and strong-arming them into a deal to provide sufficient liquidity to end the runs on banks and brokerages.

No one was happy with that expediency, and in 1908 Congress passed the Aldrich-Vreeland Act, which formed the National Monetary Commission. Senator Nelson Aldrich, a Rhode Island Republican and sponsor of the act, embarked on a fact-finding mission to Europe, where he met with government ministers and bankers.

The panic had shown that the existing financial system, founded on government bonds, was brittle and ponderous. But, although voters were eager for a more robust and responsive system, there was no support at the time for a central bank either from the public or from industrialists. Both were suspicious of such government interference.

The Jekyll Island collaborators knew that public reports of their meeting would scupper their plans. The idea of senior officials from the Treasury, Congress, major banks and brokerages (along with one foreign national) slipping off to design a new world order has struck generations of Americans as distasteful at best and undemocratic at worst — and would have been similarly received at the time. So the meeting of the minds was planned under the ruse of a gentlemen’s duck-hunting expedition.

Aldrich, an archetype of his age, was a personal friend of Morgan, and Aldrich’s daughter was married to John D. Rockefeller Jr. He found in the European central banks a useful model. Although the financial system in the U.S. was functional enough to stoke the engines of a growing industrial economy, it was a classic example of the persistence of interim solutions. The models Aldrich found in Europe were more efficient and effective.

What he lacked was a way to graft those characteristics onto the American economy without retarding it. Hence the duck hunt.

Aldrich invited men he knew and trusted, or at least men of influence who he felt could work together. They included Abram Piatt Andrew, assistant secretary of the Treasury; Henry P. Davison, a business partner of Morgan’s; Charles D. Norton, president of the First National Bank of New York; Benjamin Strong, another Morgan friend and the head of Bankers Trust; Frank A. Vanderlip, president of the National City Bank; and Paul M. Warburg, a partner in Kuhn, Loeb & Co. and a German citizen.

The men made their way to the island by private railway car and ferry.

In Vanderlip, Aldrich had found the tactician to design a functional American central bank. Vanderlip was born a farm boy in Aurora, Illinois, put himself through college, and worked his way up the Chicago financial ladder. He became personal assistant to Treasury Secretary Lyman Gage, and in 1898 made his mark managing loans to the government to finance the Spanish-American War.

As Bertie Charles Forbes related in his 1916 book, “Men Who Are Making America”:

<BLOCKQUOTE>

Vanderlip knew more about government bonds than any other man living. He knew other banks would like to be relieved of all the red tape incidental to buying and putting up bonds to cover circulation, depositing reserves to cover note issues &c. He began to dictate a circular letter to be sent broadcast to the country’s 4,000 national banks.

</BLOCKQUOTE>

That was exactly the kind of perspicacity Aldrich was seeking. The collaborators spent 10 days on Jekyll Island. What emerged was an idea for something called the National Reserve Association, which would act as a central bank, issuing currency and holding member banks’ reserves. While it would handle government debt, it would be a private institution. The U.S. Treasury would have a seat on the board, but would exercise no further oversight.

The reserve association was brought to Congress as the “Aldrich plan,” and it got nowhere. There was opposition in both parties, from populist William Jennings Bryan, a Nebraska Democrat, to progressive Robert La Follette, a Wisconsin Republican.

Woodrow Wilson ran for president opposed to the bankers’ club but committed to financial reform. There followed a blizzard of proposals from every part of the political spectrum. Eventually, Carter Glass, a Virginia Democrat and the chairman of the House banking committee, drafted what would become the Federal Reserve Act with the help of Robert Latham Owen, an Oklahoma Democrat. The act became law at the end of 1913.

Although the Glass-Owen bill was a compromise, the core of the Aldrich plan remained. There were many minor detail changes from the Jekyll Island accords, but the major one was a more prominent role given to the Treasury. (To this day the debate continues as to whether the Fed is truly independent, or should be.) Benjamin Strong, one of the Jekyll Island cohorts, became the first president of the New York Federal Reserve in 1914.

Today, a central bank is the global standard. All 187 members of the International Monetary Fund have them. In November 2010, Fed Chairman Ben S. Bernanke held a press conference on Jekyll Island to celebrate the centennial of the meeting. Aldrich and his colleagues would have been proud of their accomplishment — but mortified by the publicity.

(Gregory DL Morris is a member of the editorial board of the Museum of American Finance, a Smithsonian affiliate, and a contributor to the Echoes blog. The opinions expressed are his own.)

→ Leave a comment

Posted in Banking Cartels, Banksters, Economic Takedown, Illuminati Elites

http://aftermathnews.wordpress.com/

Posted on February 20, 2012 | Leave a comment

President Woodrow Wilson signing the Federal Reserve Act in 1913. Source: Woodrow Wilson Birthplace Foundation, painting by Wilbur G. Kurtz Sr.

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the civilized world — no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and duress of a small group of dominant men.”

- President Woodrow Wilson reflecting in 1916 on his approval of the Federal Reserve Act in 1913. Quoted in “National Economy and the Banking System,” Senate Documents Co. 3, No. 23, Seventy-sixth Congress, First session, 1939

“Since I entered politics, I have chiefly had men’s views confided to me privately. Some of the biggest men in the United States, in the Field of commerce and manufacture, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they better not speak above their breath when they speak in condemnation of it.”

- President Woodrow Wilson, The New Freedom, 1913

bloomberg.com | Feb 15, 2012

By Gregory DL Morris

Although it may seem shocking to watch the 112th Congress, there was a time when national leaders were swift and decisive in getting things done. In November 1910, in the space of less than two weeks, a group of government and business leaders fashioned a powerful new financial system that has survived a century, two world wars, a Great Depression and many recessions.

Of course, the Jekyll Island conference, which met that month, was dodgy even by the standards of the Gilded Age: a self-selected handful of plutocrats secretly meeting at a private resort island to draw up a new framework for the nation’s banking system. Add in the gnarly live oaks and dripping Spanish moss of coastal Georgia, and the baronial becomes baroque.

The group’s original plan wasn’t ratified by Congress, but one very much like it was adopted and became the basis of the Federal Reserve system that remains in place today.

At the time, the Panic of 1907 was still fresh in everyone’s mind. J.P. Morgan had resolved that panic by locking the heads of major banks in his library overnight, and strong-arming them into a deal to provide sufficient liquidity to end the runs on banks and brokerages.

No one was happy with that expediency, and in 1908 Congress passed the Aldrich-Vreeland Act, which formed the National Monetary Commission. Senator Nelson Aldrich, a Rhode Island Republican and sponsor of the act, embarked on a fact-finding mission to Europe, where he met with government ministers and bankers.

The panic had shown that the existing financial system, founded on government bonds, was brittle and ponderous. But, although voters were eager for a more robust and responsive system, there was no support at the time for a central bank either from the public or from industrialists. Both were suspicious of such government interference.

The Jekyll Island collaborators knew that public reports of their meeting would scupper their plans. The idea of senior officials from the Treasury, Congress, major banks and brokerages (along with one foreign national) slipping off to design a new world order has struck generations of Americans as distasteful at best and undemocratic at worst — and would have been similarly received at the time. So the meeting of the minds was planned under the ruse of a gentlemen’s duck-hunting expedition.

Aldrich, an archetype of his age, was a personal friend of Morgan, and Aldrich’s daughter was married to John D. Rockefeller Jr. He found in the European central banks a useful model. Although the financial system in the U.S. was functional enough to stoke the engines of a growing industrial economy, it was a classic example of the persistence of interim solutions. The models Aldrich found in Europe were more efficient and effective.

What he lacked was a way to graft those characteristics onto the American economy without retarding it. Hence the duck hunt.

Aldrich invited men he knew and trusted, or at least men of influence who he felt could work together. They included Abram Piatt Andrew, assistant secretary of the Treasury; Henry P. Davison, a business partner of Morgan’s; Charles D. Norton, president of the First National Bank of New York; Benjamin Strong, another Morgan friend and the head of Bankers Trust; Frank A. Vanderlip, president of the National City Bank; and Paul M. Warburg, a partner in Kuhn, Loeb & Co. and a German citizen.

The men made their way to the island by private railway car and ferry.

In Vanderlip, Aldrich had found the tactician to design a functional American central bank. Vanderlip was born a farm boy in Aurora, Illinois, put himself through college, and worked his way up the Chicago financial ladder. He became personal assistant to Treasury Secretary Lyman Gage, and in 1898 made his mark managing loans to the government to finance the Spanish-American War.

As Bertie Charles Forbes related in his 1916 book, “Men Who Are Making America”:

<BLOCKQUOTE>

Vanderlip knew more about government bonds than any other man living. He knew other banks would like to be relieved of all the red tape incidental to buying and putting up bonds to cover circulation, depositing reserves to cover note issues &c. He began to dictate a circular letter to be sent broadcast to the country’s 4,000 national banks.

</BLOCKQUOTE>

That was exactly the kind of perspicacity Aldrich was seeking. The collaborators spent 10 days on Jekyll Island. What emerged was an idea for something called the National Reserve Association, which would act as a central bank, issuing currency and holding member banks’ reserves. While it would handle government debt, it would be a private institution. The U.S. Treasury would have a seat on the board, but would exercise no further oversight.

The reserve association was brought to Congress as the “Aldrich plan,” and it got nowhere. There was opposition in both parties, from populist William Jennings Bryan, a Nebraska Democrat, to progressive Robert La Follette, a Wisconsin Republican.

Woodrow Wilson ran for president opposed to the bankers’ club but committed to financial reform. There followed a blizzard of proposals from every part of the political spectrum. Eventually, Carter Glass, a Virginia Democrat and the chairman of the House banking committee, drafted what would become the Federal Reserve Act with the help of Robert Latham Owen, an Oklahoma Democrat. The act became law at the end of 1913.

Although the Glass-Owen bill was a compromise, the core of the Aldrich plan remained. There were many minor detail changes from the Jekyll Island accords, but the major one was a more prominent role given to the Treasury. (To this day the debate continues as to whether the Fed is truly independent, or should be.) Benjamin Strong, one of the Jekyll Island cohorts, became the first president of the New York Federal Reserve in 1914.

Today, a central bank is the global standard. All 187 members of the International Monetary Fund have them. In November 2010, Fed Chairman Ben S. Bernanke held a press conference on Jekyll Island to celebrate the centennial of the meeting. Aldrich and his colleagues would have been proud of their accomplishment — but mortified by the publicity.

(Gregory DL Morris is a member of the editorial board of the Museum of American Finance, a Smithsonian affiliate, and a contributor to the Echoes blog. The opinions expressed are his own.)

→ Leave a comment

Posted in Banking Cartels, Banksters, Economic Takedown, Illuminati Elites

http://aftermathnews.wordpress.com/

Temas similares

Temas similares» JOHN F. KENNEDY Y LA RESERVA FEDERAL

» MULEROS Y EXILIADOS CUBANOS CHOCAN FRENTE A LAS OFICINAS DEL REPRESENTANTE FEDERAL MARIO DIAZ BALART

» ¿DE DÓNDE VENIMOS?, ¿QUIENES SOMOS?, ¿A DÓNDE VAMOS?

» MULEROS Y EXILIADOS CUBANOS CHOCAN FRENTE A LAS OFICINAS DEL REPRESENTANTE FEDERAL MARIO DIAZ BALART

» ¿DE DÓNDE VENIMOS?, ¿QUIENES SOMOS?, ¿A DÓNDE VAMOS?

Página 1 de 1.

Permisos de este foro:

No puedes responder a temas en este foro.

» Cines de Cuba

» Visita del MRGM Ernesto Zamora a la Logia Renacer No. 410

» Spectre (2015) - Original Soundtrack Extended

» LAS LOGIAS EN CUBA

» 200th Class Reunion November 3 & 4

» 200th Class Reunion Cap and Ring Ceremony

» Fraternidad UD Primera Sesión 21 de Noviembre de 2019

» Knights of St. Andrew Valle de Miami, Oriente de la Florida